You should reconcile weekly, if not daily, to ensure that your accounts are as accurate as possible.

Xero remembers the last time you categorised a transaction, so you can simply click ‘OK’ if you want it to go to the same category. As Xero is connected to your bank, transactions are pulled through automatically.

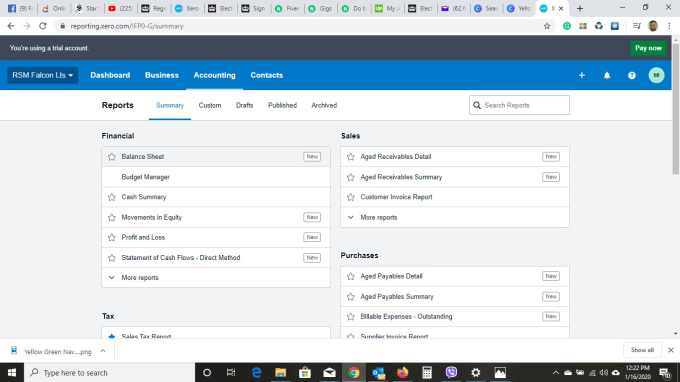

Just a few minutes a week spent approving pre-matched items ensures your data is up to date. Xero makes bank reconciliation easier than ever. The next step is to set up your bank account feeds, including credit card and PayPal accounts, if you have them. For more information on customising your chart of accounts, click here. To make changes to your accounts, go to Accounting > Chart of Accounts. You can add, customise, or delete these accounts to match the needs of your business. However, if you are your own bookkeeper then we recommend using Xero’s default chart of accounts. If you have an accountant, you can seek their help with this decision. If you are switching from another accounting software, then you can import your chart of accounts into Xero, or modify the default chart of accounts. Having shorter payment terms can help you to get paid earlier.

Nailing down your terms of payment can help you to improve your cash flow. To set up various branding schemes, go to Settings > Invoice Settings Next, you can set up your invoices with terms of payment, contract, and logo.

Here are 13 steps to get you started using Xero to get a better handle on your finances. If you’re new to Xero, then this guide to getting started should help you quickly get up and running. Xero is an online accounting software designed for small businesses.

0 kommentar(er)

0 kommentar(er)